Remember when we used to travel? A quick flight to Perth for a wedding, a weekend skiing in New Zealand, a few days relaxing with the family on a beach in Bali?

Back when international travel wasn’t just a distant dream, travel insurance was the most commonly sold add-on insurance in Australia, with over a million products sold per year.

Add-on insurance is different from insurance bought directly from insurers, because it is sold – as its name implies –as an ’add-on’ to a primary purchase. While travel insurance can be bought as an add-on (in the same transaction as you buy your flight), it can also be bought direct from third party sellers. Other add-on insurance – for example tyre and rim insurance – is only ever sold along with a primary product or service. It is not the type of insurance, but the way it is sold, that determines whether insurance is ’add-on’, and this has important implications for sales practices and consumer decision-making.

Add-on insurance can be poor value for consumers (see also Treasury, 2019). Salespeople may take advantage of the situation to sell you an uncompetitive product (details of problematic sales practices provided here and here). For example, you’ve just spent a bunch of money on a primary purchase, and maybe you’ve developed a good rapport with the salesperson – this could make it harder to say ‘no’ to the add-on insurance they are selling.

BETA worked with the Australian Securities and Investments Commission (ASIC) to develop an information statement that would slow down the decision of whether or not to buy add-on insurance, by creating a buffer between the primary purchase and the insurance product. ASIC’s earlier work has shown disclosure and disclaimers are ’often not sufficient to drive good consumer outcomes’, so in addition to informing and educating (e.g., about the value of the insurance; or about the fact that the insurance is not compulsory), the information sheet also empowered consumers to act: to opt out of follow-up, or say no to offers of add-on insurance.

We designed six different versions of the information sheet, by varying the design and the specific information provided about the insurance product. We put these versions to the test against business-as-usual (no information sheet) in a framed field experiment.

In the experiment, over 6000 participants went through a hypothetical shopping scenario in which they either booked flights, bought a mobile phone, or arranged a loan. Then, the ’salesperson’ or website in the scenario offered them some add-on insurance (travel insurance, mobile phone insurance, or consumer credit insurance). Participants were randomised to either a control condition – these participants saw no information statement – or an intervention condition – these participants saw one of six information statements. Then we asked whether they wanted to ‘buy’ the advertised add-on insurance.

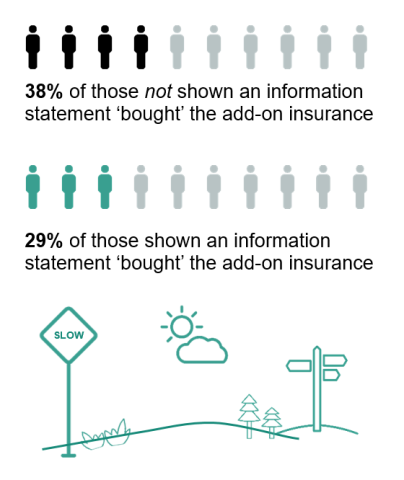

We found those participants who had not seen the information sheet (’business as usual’) bought the add-on insurance 38 per cent of the time. But those participants who had seen an information sheet bought the add-on insurance 29 per cent of the time. This represents a 9 percentage point reduction in add-on insurance sold (24 per cent decrease).

We did not find much of a difference between the different versions of the information sheets. Like in several other BETA evaluations, the intervention worked – but smaller details like colour or wording appeared to matter less. So how did the information sheet have its effect? Our follow-up analyses suggest participants noticed, liked, and were helped by sections of the information sheet saying ’this insurance is not compulsory’, and by the option to opt out of further follow-up. Put simply, they were given permission to say ‘no’.

This study supports the use of timely, clear, and engaging prompts to help slow down the decision-making process, remind consumers add-on insurance is not compulsory, and provide them with an easy mechanism for opting out of follow-up. Further research with consumers in real-world settings will help determine the long term impact of the information statement (and associated deferred sales period) on sales and quality of add-on insurance in Australia. Hopefully we’ll be allowed to travel again soon, and will get to see an information sheet in action!